If you want to be in a meaningfully better financial position, this matters more than any stock tip, market forecast, or hot investment idea.

After more than a decade of investing, making both good and bad decisions, I’ve learned that long-term wealth isn’t built by chasing returns. It’s built by creating calm, control, and consistency before you put more money into the market.

This article outlines the five financial foundations I’d focus on first, whether you’re already investing or simply looking to get your money in better shape.

Not to get rich quickly but to keep more of what you earn, reduce emotional decisions, and make investing feel boring in the best possible way.

Full Video. Do These 5 Things First.

1. Kill Your Money Leaks (Without Going Extreme)

You don’t need a strict budget.

You don’t need to track every coffee or count every penny.

What you do need is awareness.

Most people lose money quietly through subscriptions, lifestyle creep, and spending they no longer notice. These leaks drain cash flow every month and reduce how much you can invest without ever feeling obvious.

What to focus on

- Subscriptions you don’t use

- Apps, memberships, or services you forgot existed

- Lifestyle upgrades that crept in without intention

If you’re not using it, get rid of it. That alone can free up £50–£300 per month for investing, saving, or simply breathing room.

Banking apps like Monzo make this easier by automatically categorising spending and showing where your money actually goes. You don’t need Monzo specifically any bank that gives you visibility will do but the goal is the same: remove quiet drains, not joy.

Tip: When cancelling subscriptions, many services offer discounts to keep you. Even staying can reduce costs.

2. Run a Full Financial Audit (Once a Year)

This isn’t about guilt.

It’s about control.

A financial audit is a one-off, high-level review of where your money has gone over the past year not a daily obsession.

Why this matters

Most people don’t have a money problem.

They have a visibility problem.

When you zoom out, patterns appear:

- Spending more during summer months

- Overspending on takeaways or Amazon

- Lifestyle spikes that don’t align with priorities

Understanding your own behaviour is far more powerful than copying someone else’s budget.

Once you see the patterns, you can make small, intentional adjustments not emotional overreactions.

Open A Monzo Account | Quick & Easy

Organise, save & invest with a free UK current account, joint account or business account. Make your money more Monzo.

3. Reset Your Safety Net With an Emergency Fund

Every poor investment decision I’ve made came from not feeling secure.

An emergency fund changes how you think.

What an emergency fund does

- Stops forced selling during market dips

- Reduces panic when unexpected costs appear

- Makes investing feel optional, not stressful

You don’t need perfection.

You need peace of mind.

For most people, this means holding 3–6 months of essential expenses in an easy-access savings account. Once this exists, every other financial decision becomes calmer and more rational.

This is what allows you to invest money you can genuinely afford to leave alone.

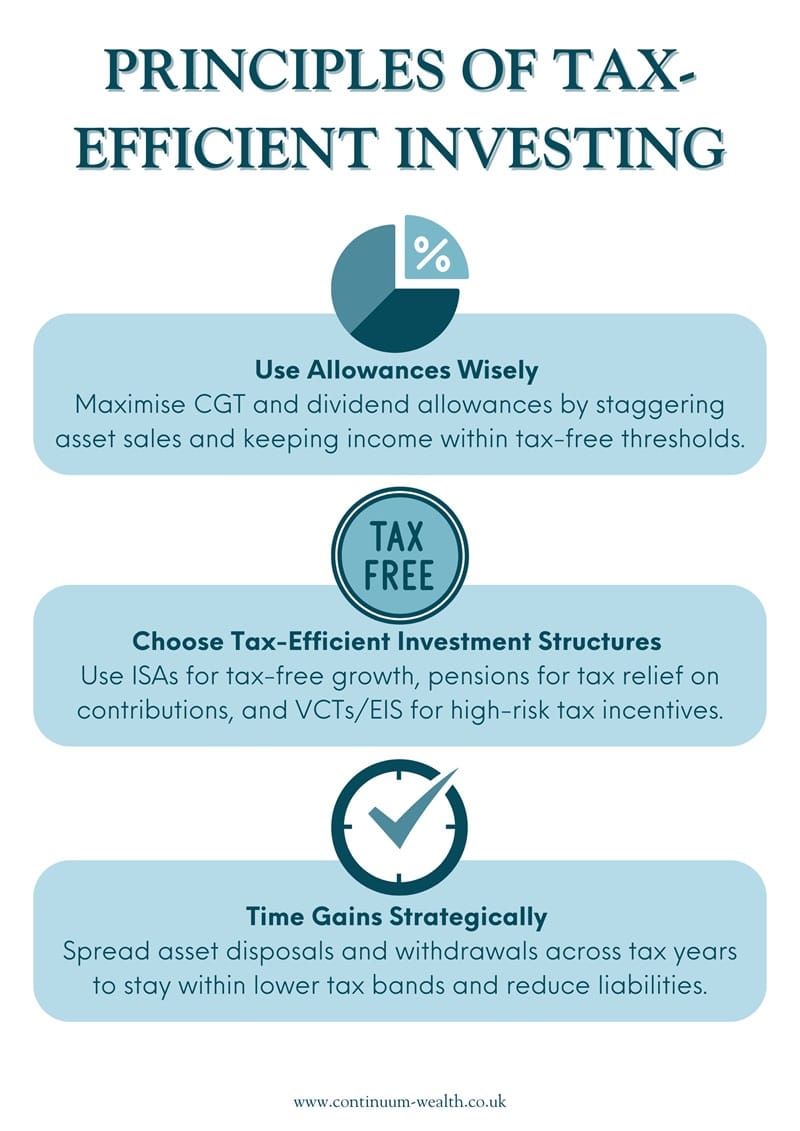

4. Fix the Boring Stuff: Tax Efficiency Beats Returns

Most people chase higher returns while ignoring the biggest guaranteed win in personal finance: tax efficiency.

It’s not exciting but it works.

Key areas to review

ISAs

- Are you using your full ISA allowance?

- Are your investments sheltered from unnecessary tax?

ISAs protect your investments from capital gains tax and dividend tax, making them one of the most powerful long-term tools available to UK investors.

Official rules can be found on GOV.UK.

Pensions

- Are you getting full employer contributions?

- Are you benefiting from tax relief?

Platforms like PensionBee simplify pension management and automatically apply government top-ups which is effectively free money for long-term investors.

General Investing Accounts

If you invest outside tax shelters, understanding capital gains and potential loss harvesting matters but ISAs and pensions should come first for most people.

People focus on returns they might get, instead of tax they’re guaranteed to avoid.

5. Set Fewer Goals Then Automate Them

Financial goals shouldn’t look good on paper.

They should make you feel calm and in control.

Instead of vague resolutions, focus on clear priorities.

Examples of practical goals

- Invest £250 per month automatically

- Maximise ISA contributions before April

- Increase pension contributions by 1–2%

- Reduce one recurring expense permanently

The most important step is automation.

When investing is scheduled alongside bills early in the month it stops being optional. It happens in the background, quietly compounding while life continues.

Consistency beats motivation every time.

Shop Away Your Mortgage | Earn Cashback & Send To Your Lender

This Is a Framework, Not Perfection

This isn’t about optimisation.

It’s about foundations.

Before chasing:

- Higher returns

- Complex strategies

- Side hustles or speculative ideas

You need:

- Clear cash flow

- Visibility

- Tax efficiency

- A safety net

- Simple, automated goals

Wealth is built quietly, over time, by people who remove friction not by those who constantly react.