Educational content only. This article reflects UK rules as of January 2026 and is based on real‑world experience, not accounting advice. Always check the latest HMRC guidance or speak to a qualified professional.

Why does this matter if you’re building wealth long-term

If you’re using a side hustle, investing, or content income to accelerate long‑term wealth, tax admin is unavoidable. Ignore it, and you risk stress, penalties, or surprise bills that undo months (or years) of sensible investing.

Handled properly, Self Assessment becomes boring admin — and boring is exactly what long‑term investors want.

This guide follows the same framework as the video, so you can read alongside it, then embed the video into the article.

Who actually needs to complete a Self Assessment?

In simple terms, you usually need to file a UK Self Assessment if either of the following apply:

- You earned money outside PAYE (side hustle, freelance work, online income)

- You sold assets such as shares, crypto, or property and triggered Capital Gains Tax

If HMRC asks you to complete one, it isn’t optional.

The good news: once you’ve done it once, it stops feeling scary. It’s admin — not a judgement.

Important note: There’s increasing use of data matching and technology to cross‑check income and transactions. Whether that’s platforms, banks, or blockchain data, the safest approach is simply to stay compliant.

Income from a side hustle: what’s actually taxable?

Most people underestimate this part.

You receive a £1,000 trading allowance each tax year. Anything above that is taxable.

Example:

- Salary: £40,000 (already taxed via PAYE)

- Side hustle income: £5,000

- Taxable side hustle income: £4,000

That £4,000 is added on top of your existing income and taxed at your marginal rate.

This is where many people go wrong, they mentally separate side income from salary, but HMRC doesn’t.

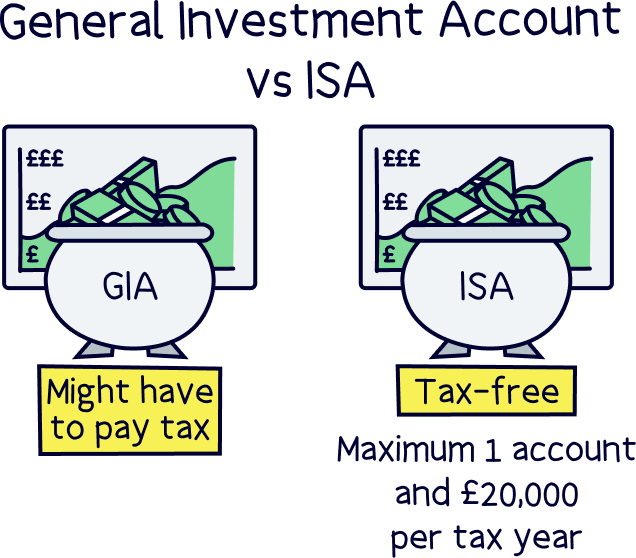

Capital Gains Tax: investing outside tax wrappers

Capital Gains Tax (CGT) applies when you sell assets for a profit outside tax‑efficient accounts.

Broadly:

- Basic‑rate taxpayers: lower CGT rate

- Higher‑rate taxpayers: higher CGT rate

This applies to:

- Shares

- Crypto

- Property

Losses can usually be offset against gains within general investment accounts (not ISAs).

This is why long‑term investors prioritise tax wrappers first, before taxable accounts.

Registering for Self Assessment (and why timing matters)

If you’re earning taxable income outside PAYE, you’ll need to:

- Register as self‑employed

- Receive a Unique Taxpayer Reference (UTR)

This process can take weeks, not days.

Do not wait until January. Register early and remove the stress entirely.

One decision that makes everything easier: separate accounts

If you take nothing else from this article, take this:

Run side hustle income through a separate bank account.

Why it matters:

- Clean income tracking

- Clear expenses

- Faster Self Assessment

- Easier accountant hand‑off

Mixing personal and side income creates chaos — and chaos costs money.

Open A Monzo Account | Quick & Easy

Organise, save & invest with a free UK current account, joint account or business account. Make your money more Monzo.

Tracking income and expenses properly

You can track everything manually in a spreadsheet.

But long‑term, boring accuracy beats clever shortcuts.

Simple accounting tools:

- Automatically track income

- Categorise expenses

- Export clean reports for tax returns

This removes guesswork and reduces errors especially once income grows.

Investing records: what HMRC expects

If you trade or invest outside ISAs, you’ll need:

- Transaction history

- Fees and costs

- Realised profits and losses

Download reports from your broker covering 6 April to 5 April for each tax year.

From there:

- Summarise gains and losses

- Offset where allowed

- Identify any taxable amount

This is admin, not analysis treat it like filing paperwork, not trading decisions. If you want to make it easier, allow ChatGPT to double check it for you.

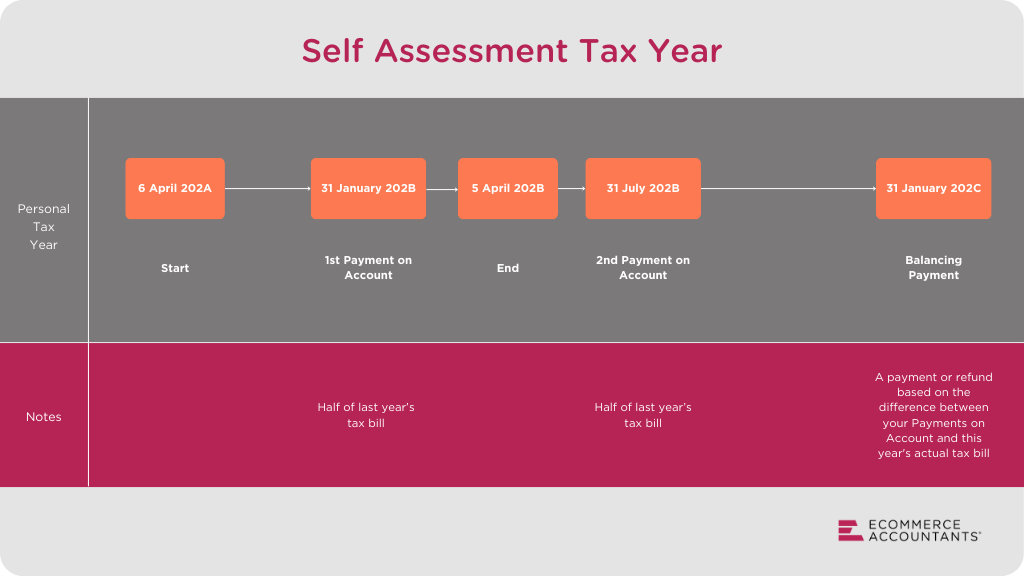

Pay on Account: the part that catches people out

Pay on Account is not a fine but it feels like one the first time.

It applies when:

- Your tax bill exceeds £1,000

- Less than 80% of tax was collected via PAYE

HMRC asks you to prepay part of next year’s tax in two instalments:

- January

- July

So a tax bill might look huge when part of it is simply next year paid early.

This is why saving for tax as income arrives is essential.

Should you use an accountant?

You can do Self Assessment yourself.

But if you have:

- Multiple income streams

- Capital gains

- Pay on Account

- Growing side income

A professional often pays for themselves in:

- Reduced mistakes

- Clear explanations

- Time saved

- Peace of mind

Long‑term wealth is about systems, not DIY stress.

TaxFix: Tax return plans to fit your needs

Get your tax return filed accurately & avoid costly mistakes

How long‑term investors legally reduce tax

This is where sensible planning beats shortcuts.

1. Use ISAs first

- No Capital Gains Tax

- No dividend tax

- No reporting

For most investors, ISAs are the foundation.

2. Use pensions strategically

Pensions reduce taxable income and receive government top‑ups.

They’re long‑term by design which aligns perfectly with patient investing.

3. Understand business structures

As income grows, many people explore limited companies.

Why?

- Control when income is taken

- Separate personal tax from business profits

- More flexibility over timing

This isn’t about avoiding tax it’s about not paying tax before you need to.

The long‑term mindset that makes this easy

Self Assessment feels stressful when:

- Income is disorganised

- Records are missing

- Tax isn’t set aside

It feels boring when:

- Accounts are separated

- Tracking is automatic

- Savings happen alongside income

Boring is good.

Boring means you can focus on:

- Investing consistently

- Using ISAs and pensions properly

- Letting compounding do the work

Final thoughts

Self Assessment isn’t scary disorganisation is.

If you’re building wealth through investing, dividends, and sensible systems, tax admin is simply part of the process.

Get the structure right early, stay boring, and let time do the heavy lifting.

That’s how long‑term wealth is actually built.