That’s why many wealthy investors rely on accumulation ETFs funds that quietly reinvest dividends and compound in the background without needing constant decisions.

In this guide, we’ll break down:

- What accumulation ETFs are (and how they differ from income funds)

- Why wealthy investors prefer them for long-term growth

- The five most popular accumulation ETFs in the UK

- How to combine them into a simple, low-stress portfolio

This article is UK-focused and designed for Stocks & Shares ISAs and pensions.

Watch the full video version of Accumulation Funds

Accumulation vs Distribution ETFs (Simple Explanation)

Before looking at specific funds, it’s important to understand the difference between accumulation and distribution ETFs.

Accumulation ETFs

- Dividends are automatically reinvested

- No cash is paid out

- Growth compounds internally

- You sell units when you want to withdraw money

These are ideal for:

- Long-term growth

- Younger investors

- Hands-off investing

- Removing emotional decisions

Distribution ETFs

- Dividends are paid out as cash

- You decide whether to reinvest

- Useful for income later in life

Personally, I use distribution ETFs for cash flow, but for pure growth, accumulation funds are the engine.

They remove the biggest enemy of investing: human behaviour.

No temptation to spend dividends.

No missed reinvestments.

No tinkering.

Why Accumulation ETFs Are So Popular With Wealthy Investors

Across ISAs and pensions, accumulation ETFs dominate and for good reason.

They offer:

- Low costs

- Broad diversification

- Time in the market

- Consistency

1. S&P 500 Accumulation ETF (CSP1)

Ongoing Charge: 0.07%

Focus: 500 largest US companies

Style: Growth-led, tech-heavy

This is one of the most popular ETFs in the world and for good reason.

The S&P 500 has delivered consistent long-term growth over decades, driven by:

- US innovation

- Global mega-cap companies

- Strong earnings growth

While it can underperform in certain years, its long-term consistency is unmatched.

If you want:

- Simple exposure to US growth

- Low fees

- Proven performance

This is often the first ETF people start with.

2. MSCI World Accumulation ETF

Ongoing Charge: Slightly higher than S&P 500

Holdings: 1,300 companies

Coverage: Developed markets worldwide

This ETF gives you:

- US exposure

- Europe

- Japan

- Other developed economies

It’s often considered the ultimate beginner ETF because it offers instant global diversification in a single fund.

Volatility tends to be lower than the S&P 500, but returns remain competitive over time.

If you want a big brushstroke approach to global investing, this is where many portfolios begin.

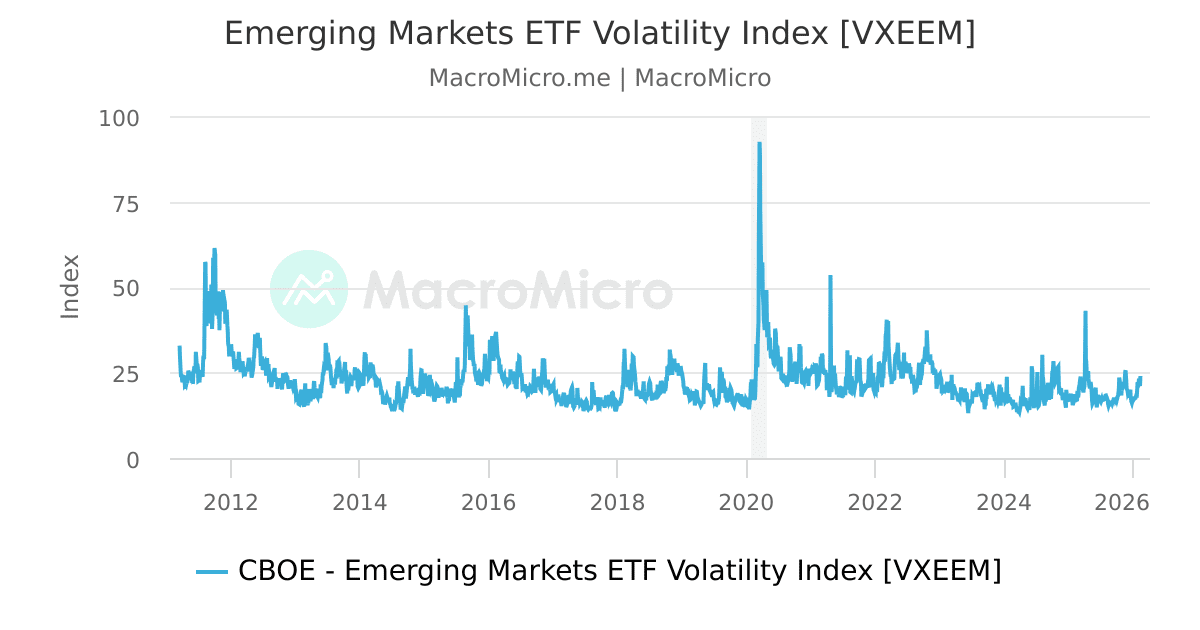

3. Emerging Markets Accumulation ETF

Holdings: 3,000 companies

Risk Level: Higher

Potential: Long-term growth, high volatility

Emerging markets include:

- China

- India

- Brazil

- Southeast Asia

These markets offer huge growth potential, but returns can be uneven.

You may see:

- Strong rallies

- Long periods of stagnation

- Higher geopolitical risk

This ETF works best as a small satellite holding, not a core position.

Think of it as:

- Optional upside

- Not something to rely on alone

4. Vanguard FTSE All-World Accumulation ETF (VWRP)

Holdings: 3,000+ companies

Coverage: Developed + emerging markets

Style: One-fund solution

This is one of the most popular long-term ETFs in the UK.

It gives you:

- Global diversification

- Emerging markets exposure

- Minimal decision-making

If you want:

- One ETF

- Maximum simplicity

- Long-term growth

This is hard to beat.

Many investors build their entire portfolio around this fund alone.

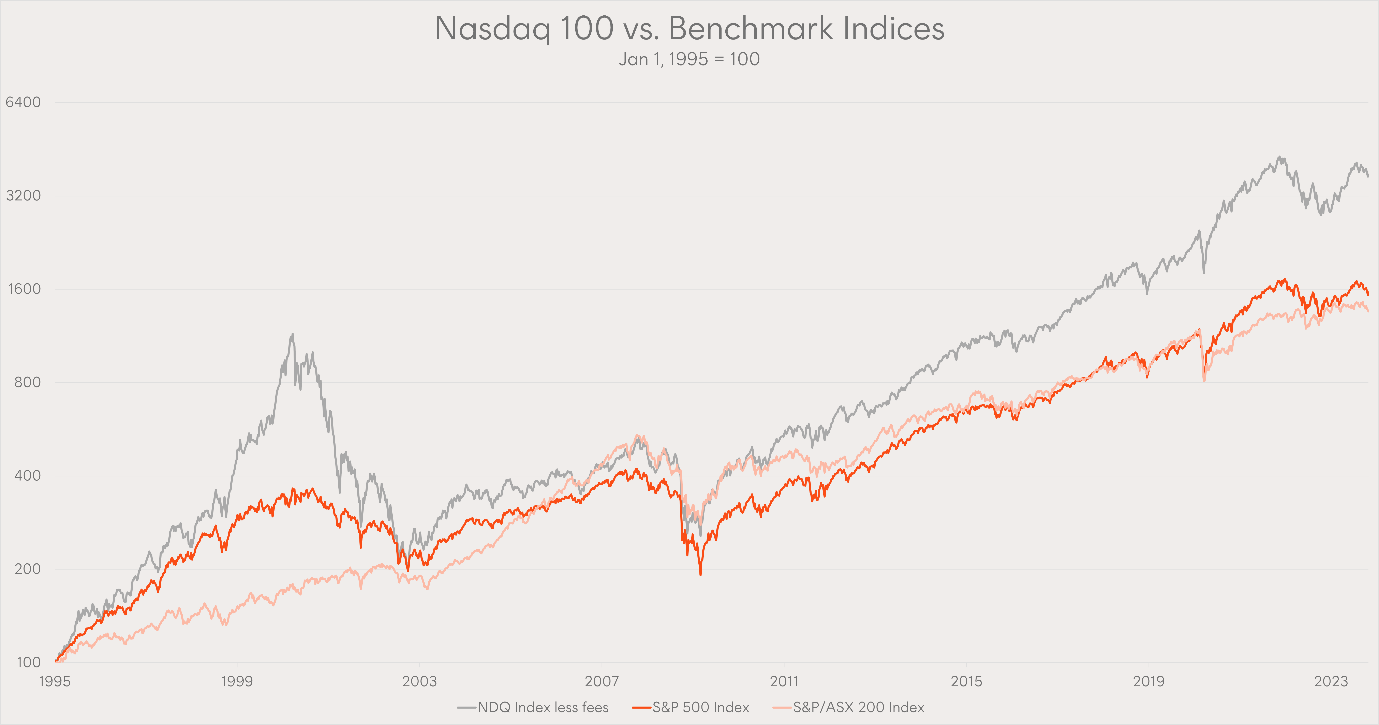

5. NASDAQ 100 Accumulation ETF

Focus: US technology and innovation

Risk: Higher volatility

Reward: Strong long-term growth

This ETF is dominated by:

- Big tech

- AI

- Cloud computing

- Innovation leaders

Returns can be exceptional but swings can be sharp.

Best used as:

- A satellite growth allocation

- Not your entire portfolio

Technology will likely continue shaping the future but diversification still matters.

How to Build a Simple Long-Term ETF Portfolio

You don’t need 15 funds. Most long-term investors are better served by:

- 1 core ETF

- 1–2 optional satellites

Example structure:

- 60–80% All-World or MSCI World

- 10–20% S&P 500 or NASDAQ

- 0–10% Emerging Markets

The goal is not perfection, it’s consistency.

The biggest mistake investors make isn’t choosing the wrong ETF.

It’s changing strategy mid-way.

Fees Matter (But Don’t Obsess)

Low fees compound in your favour over decades.

Avoid:

- Niche hype ETFs

- Expensive thematic funds

- Over-engineering portfolios

Boring works.

Fees are one of the few things you can control keep them sensible.

Final Thoughts: Wealth Is Built Quietly

Accumulation ETFs aren’t exciting.

But neither is financial stress.

Time + consistency + low costs

That’s the real edge.

If you stay invested, avoid tinkering, and let compounding do its job the results can be powerful.