Why do people use dividend ETFs in the first place

Dividend ETFs act as a comfort blanket for a lot of investors, and that’s not a bad thing.

Instead of picking 20, 30, or 40 individual dividend stocks, a single ETF can give you diversification, income, and simplicity in one place.

You get:

- Exposure to hundreds (sometimes thousands) of companies

- Regular income without constant decision-making

- Far less stress than managing individual holdings

For beginners, this removes complexity.

For experienced investors, it keeps portfolios manageable.

Personally, I hold nine assets in total:

- Six individual stocks

- Three funds

That’s it.

It’s easier to track, easier to rebalance, and easier to stick with long-term.

Yield chasing is how most people lose money

Here’s the mistake I see all the time.

Someone buys a stock yielding 6–8%.

The income feels great. Then the capital drops 30–40%, a 4% dividend on a falling asset isn’t good income.

Reliable income usually comes from:

- Strong underlying businesses

- Sustainable payout ratios

- Lower volatility

- Consistency across market cycles

Boring money often makes the most money.

Why dividend income feels different (and why that matters)

Income investing feels different to growth investing.

With growth assets, tech stocks, crypto, and even broad market ETFs, you only “win” when you sell. Until then, everything is just numbers on a screen. Literally falls off a cliff as you get excited.

Dividend income is cash flow without selling.

You can reinvest it. You can spend it. You can use it to smooth out bad years.

That’s powerful psychologically. It builds into something magical too.

It’s also why income investors tend to stay invested during drawdowns.

In my own portfolio, using conservative assumptions, dividend income could approach £10,000 per year by 2030 if I keep contributing and reinvesting.

That’s not hype.

That’s the consistency of a dividend stock's growth over time.

Growth vs income isn’t a real choice

I don’t believe in choosing one or the other.

Most investors eventually need both:

- Growth to build wealth

- Income to stabilise it

Growth gets you ahead.

Income helps you stay invested.

Over time, portfolios naturally blend the two, whether people realise it or not. It comes down to age in the end.

A big UK mistake most investors miss: withholding tax

This one catches a lot of people out. Don't worry its not terrible.

Withholding tax is a tax deducted from your dividend amount. it’s just quietly removed. But you do have to consider it on top of the fees a fund you may have will take too.

It often applies to:

- US stocks

- Global ETFs

- Funds domiciled outside the UK

Even inside an ISA, withholding tax can still apply depending on where the ETF is based. This is only on dividends too.

Typically, US withholding tax is around 15%, which reduces your actual income.

This doesn’t make a fund bad, but it absolutely affects net yield.

Always check:

- Where the ETF is domiciled

- Whether there’s a UK-listed equivalent

- Whether withholding tax applies

Many platforms don’t make this obvious.

The dividend ETFs I focus on (and why)

This isn’t a “best ETFs” list.

And it isn’t advice.

These are examples of reliable dividend ETFs and the types worth understanding.

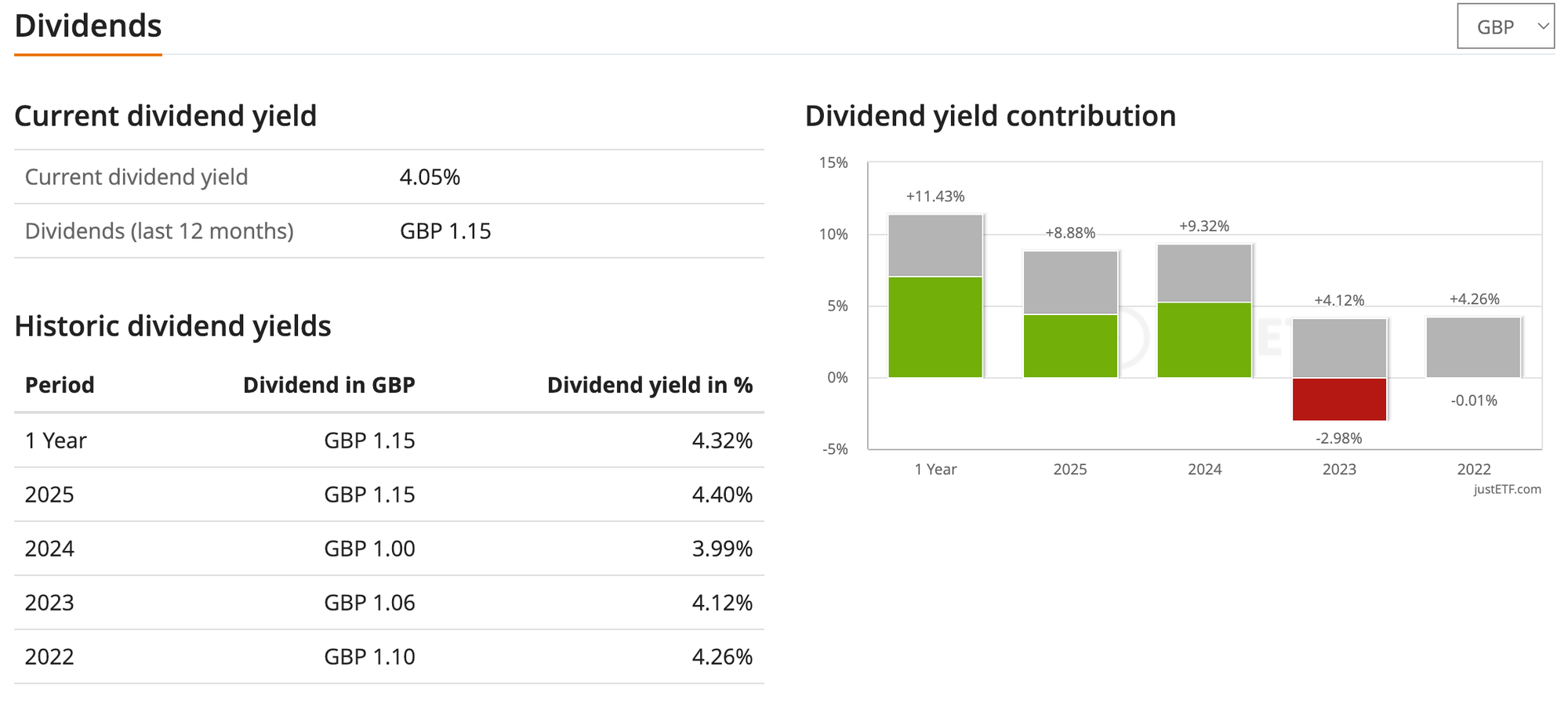

European Dividend Leaders | Ticker: TDGB

This is one of my preferred dividend funds.

It focuses on developed European markets, where dividend culture is strong, and payouts tend to be more conservative.

Roughly:

- 100 high-quality holdings

- Yield around 3–4%

- Ongoing charge ~0.38%

There is withholding tax due to domicile, but income has been consistent and volatility lower than many high-yield alternatives.

For long-term reliability, it ticks a lot of boxes.

Want to see your dividends properly?

Snowball Analytics lets you track income, growth, and yield across all your investments in one place.

UK Dividend ETFs | Tickers: IUKD

UK dividend ETFs are simple and effective.

Key advantages:

- No withholding tax

- Exposure to FTSE dividend payers

- Strong income profiles

- Generally lower volatility

Yes, UK exposure is slower and less exciting, but stability matters.

At times, yields have been around 4–5%, which rivals property income without the hassle.

Sometimes boring really is brilliant.

Global High Dividend ETFs | Ticker: VHYL

These offer extensive diversification, often with over 2,000 holdings across multiple countries.

They don’t make you rich overnight, but they tend to:

- Stay resilient

- Maintain capital reasonably well

- Continue paying income during tough markets

They’re popular starter dividend ETFs for a reason.

Dividend Aristocrats / Defensive Income | Ticker: GBDV

These funds only include companies with long histories of consistent dividend payments.

The result is usually:

- Lower volatility

- More reliable income

- Automatic removal of companies that cut dividends

That rule alone adds discipline most investors don’t have.

Quality Dividend ETFs (Growth + Income) | Ticker: FLXX

These focus on profitable companies with strong balance sheets and sustainable dividends.

Yield is typically lower, around 2–2.5%, but:

- Dividend growth potential is higher

- Capital growth can outperform traditional income funds

They work well as a hybrid between income and growth.

Don’t overcomplicate this

Some dividend investors end up with:

- 40–50 individual holdings

- Overlapping exposure

- Way too much complexity

That’s unnecessary.

A small number of high-quality dividend ETFs, combined with growth assets, is more than enough for most people.

No single ETF does everything.

That’s the point.

Final thoughts

Dividend investing isn’t exciting.

You won’t get rich overnight.

You won’t double your money in a year.

You won’t impress anyone on social media.

But if you want:

- Reliable income

- Lower volatility

- A reason to stay invested during drawdowns

- Quiet compounding over time

Dividend ETFs are incredibly powerful.

Just don’t chase yield.

Focus on reliability, structure, and tax efficiency.

That’s how you get results.