I’ve been investing for 10 years.

I’ve lived through crypto bull runs, brutal bear markets, major stock market corrections, big crashes, and the most boring sideways periods imaginable.

Looking back, there are 10 obvious lessons I wish I understood at the start.

If you’re stressing about investing, haven’t started yet, or you’re unsure what to do next, this could save you time, stress, and probably money.

And I genuinely want to know what’s the worst investing mistake you’ve ever made?

Let’s get into it.

1. Start As Young As Possible

Time in the market beats timing the market.

I started investing at 23. That sounds early, but honestly, I could have started earlier. Even small amounts in your early 20s compound massively by your 40s.

Take Warren Buffett. He started investing at 11 and filed his first tax return at 13.

His wealth didn’t explode overnight. It compounded over decades.

If you’re 40 or 50 reading this, you can’t go back. But you can start today. Even £50 per month builds the habit.

The habit is more important than the amount.

Watch the full video here

2. Budget First. Always.

Before investing, know your numbers.

I use Monzo because the insights are clear. You can see your direct debits, spending categories, and what’s actually left at the end of the month.

Budgeting gives you freedom. When you know what’s available, you invest confidently instead of dipping into savings randomly.

Simple framework:

• Budget to zero

• Cover bills and essentials

• Invest what’s left

• Automate it

Automation removes emotion. Emotion destroys returns.

Open A Monzo Account | Quick & Easy

Organise, save & invest with a free UK current account, joint account or business account. Make your money more Monzo.

3. Have an Emergency Fund Before You Invest

This is boring but critical. You need 3 to 6 months of expenses in cash before you properly invest.

Instant access. No risk.

Why?

Because if your car dies or life throws something at you, you do not want to sell investments at the worst possible time. Compounding only works if you leave money alone.

Cash protects your investments.

4. Be Open-Minded About Investments

Over 10 years I’ve moved through:

• Robo investing platforms

• 100% cryptocurrency

• Dividend stocks

• ETFs

There is no single “best” investment. There is only what suits you.

Cryptocurrency changed my life financially. I won’t pretend otherwise. But now I diversify. That’s why this channel exists.

Be curious. Adapt. The world changes. But do not overdo it. Too much diversification becomes confusion.

You wouldn’t eat unlimited chocolate just because you like it.

5. High Price Does Not Mean High Quality

Just because something is expensive doesn’t mean it’s good.

Look at Gold.

It had long periods of doing absolutely nothing before suddenly exploding higher.

I’ve chased hype before, especially in crypto. It rarely ends well. Valuation and fundamentals matter more than social media noise.

Gold might suit some portfolios. It doesn’t suit mine. Your portfolio must match your goals, not trends.

6. Data Beats Emotion

Emotion leads to poor decisions.

Data gives clarity.

Whether that’s dividend history, earnings growth, valuation metrics, or momentum trends, more quality data equals better decisions.

I use tools like Stockopedia and Snowball Analytics to understand performance properly.

Platforms like Trading 212 are fine for execution but weak for deep analysis.

If you’re buying because it’s on the news or trending on X, you’re gambling.

Research builds conviction. Conviction reduces panic.

Want to see your dividends properly?

Snowball Analytics lets you track income, growth, and yield across all your investments in one place.

7. Take Profit. Greed Kills Gains

You will never sell the top. Accept that.

If something doubles or triples, trimming is not weakness. It’s discipline. Rebalancing protects your portfolio from becoming overweight in one asset.

Locking in some gains lets you redeploy capital into new opportunities. Greed has destroyed more wealth than market crashes ever have.

8. Buy Quality When It Feels Uncomfortable

The best buys rarely feel comfortable.

When markets are red and everyone is panicking, that’s where long-term money is made.

But there’s a condition. Only buy if the fundamentals still make sense.

If new information breaks your investment thesis, cut it. Holding something you no longer believe in is not loyalty. It’s denial.

9. Use Tax Wrappers Early

If you’re in the UK, this is huge.

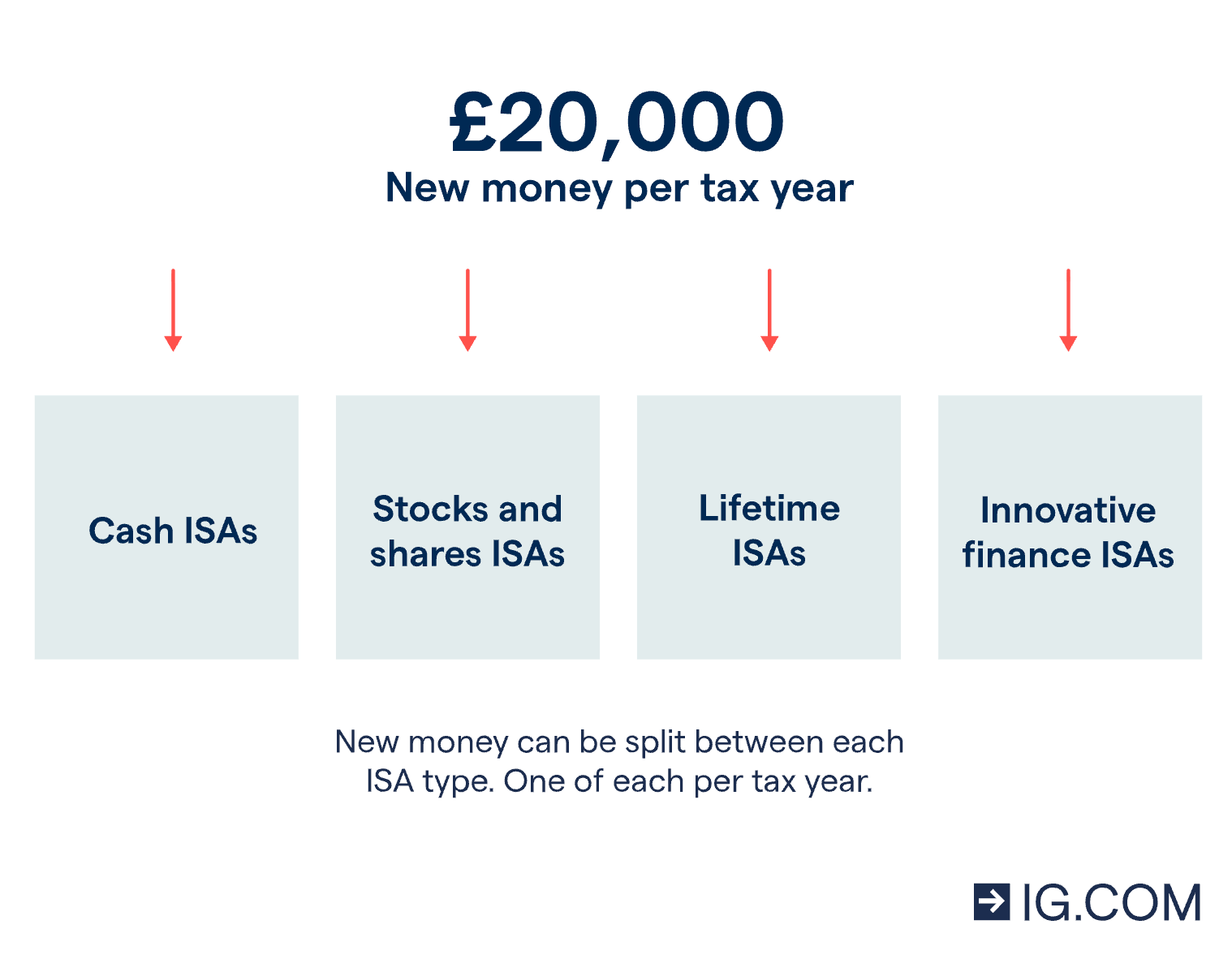

The Stocks and Shares ISA gives you £20,000 per year tax-free allowance.

Capital gains are tax-free.

UK dividends inside the ISA are tax-free.

That compounding difference over decades is massive.

I’m increasingly using global dividend ETFs like the Vanguard FTSE All-World High Dividend Yield UCITS ETF to diversify across thousands of companies while keeping it simple.

Structure matters as much as stock selection.

10. It’s Okay to Take a Loss

This is one most people struggle with.

Selling a loss is not failure. It’s freeing capital for something better.

In crypto especially, markets can drop violently. Risk management is survival. If something goes to zero, pride won’t get your money back.

Losses teach discipline. Discipline builds wealth.

The Real Lesson After 10 Years

It’s consistency. That’s it.

You do not need perfection.

You need repetition.

Just like the gym. Just like diet. Regular investing into quality assets over long periods works.

Dollar cost averaging into index funds or high-quality stocks, protecting yourself with cash buffers, using tax wrappers, and managing risk.

Do that for 10 years and your life looks very different.