When most people think about long-term investing, they think about growth.

Buy a fund. Leave it alone. Let compounding do the work.

That approach absolutely works, but it only covers one side of the equation.

The other side is income. Specifically, how income (distribution) ETFs can support long-term wealth building, improve investor behaviour, and eventually provide tax-efficient cash flow inside an ISA.

What Is an Income (Distribution) ETF?

An income (distribution) ETF is a fund that pays out dividends as cash rather than automatically reinvesting them.

The underlying holdings are often identical to the accumulation version of the same fund. The only difference is what happens to the income.

- Accumulation funds reinvest dividends automatically inside the fund

- Distribution (income) funds pay dividends into your account

Once paid out, you decide what happens next:

- reinvest it

- deploy it elsewhere

- or, later in life, spend it

The investment engine stays the same, the cash-flow behaviour changes.

Accumulation vs Distribution: The Practical Difference

| Feature | Accumulation | Distribution |

|---|---|---|

| Dividend handling | Automatically reinvested | Paid out as cash |

| Visibility | Quiet, in the background | Clear and visible |

| Control | None required | Full control |

| Best suited for | Early growth phase | Income & flexibility |

Over long periods, total return can be similar.

But how investors behave often isn’t and behaviour matters.

Join InvestingPro

Ai-Powered stock selection, discover undervalued ETFs and stocks with over 25 year + historical data and 180,000 instruments.

Why Income Funds Feel Different (Even If the Maths Is Similar)

1. Income Arrives Without Selling Assets

With distribution funds, you receive cash without needing to sell units.

That matters during volatile or sideways markets.

2. Cash Flow Changes Investor Behaviour

Income feels real. It shows progress.

For many investors, that visibility:

- reduces panic selling

- increases patience

- encourages consistency during drawdowns

3. Income Smooths the Emotional Ride

Markets don’t rise in straight lines.

A portfolio producing income can make flat or uncomfortable periods easier to stick through.

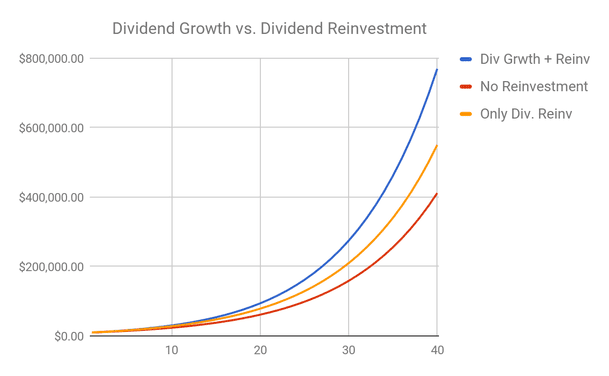

Accumulation vs Distribution Flow

Key Things to Check Before Choosing an Income ETF

Income funds aren’t “better”; they solve a different problem.

Dividend Yield Isn’t Everything

A higher yield can mean:

- slower growth

- sector concentration

- sensitivity to economic cycles

The goal isn’t maximum yield, it’s sustainable income with growth.

Fees Still Matter

Costs compound quietly over decades.

For example, two S&P 500 distribution ETFs:

- Vanguard S&P 500 UCITS ETF (VUSA) – 0.07% OCF

- SPDR S&P 500 UCITS ETF (SPX5) – 0.03% OCF

Same exposure. Different long-term drag.

Withholding Tax & Structure

International dividends may suffer withholding tax depending on fund domicile.

For UK investors, HMRC guidance:

The ETFs Referenced (With Context)

US Core Exposure (Income)

- Vanguard S&P 500 UCITS ETF (VUSA) – 0.07% OCF

- SPDR S&P 500 UCITS ETF (SPX5) – 0.03% OCF

Global “One-Fund” Income Option

Vanguard FTSE All-World UCITS ETF (VWRL)

- ~3,600 global holdings

- Quarterly income

Often used by investors who want global income without complexity.

Developed Markets (Ex-Emerging)

iShares MSCI World UCITS ETF (IWRD)

- Developed markets only

- Heavy US exposure

Europe (including the UK)

iShares Core MSCI Europe UCITS ETF (IMEU)

- ~400 holdings

- Higher income tilt

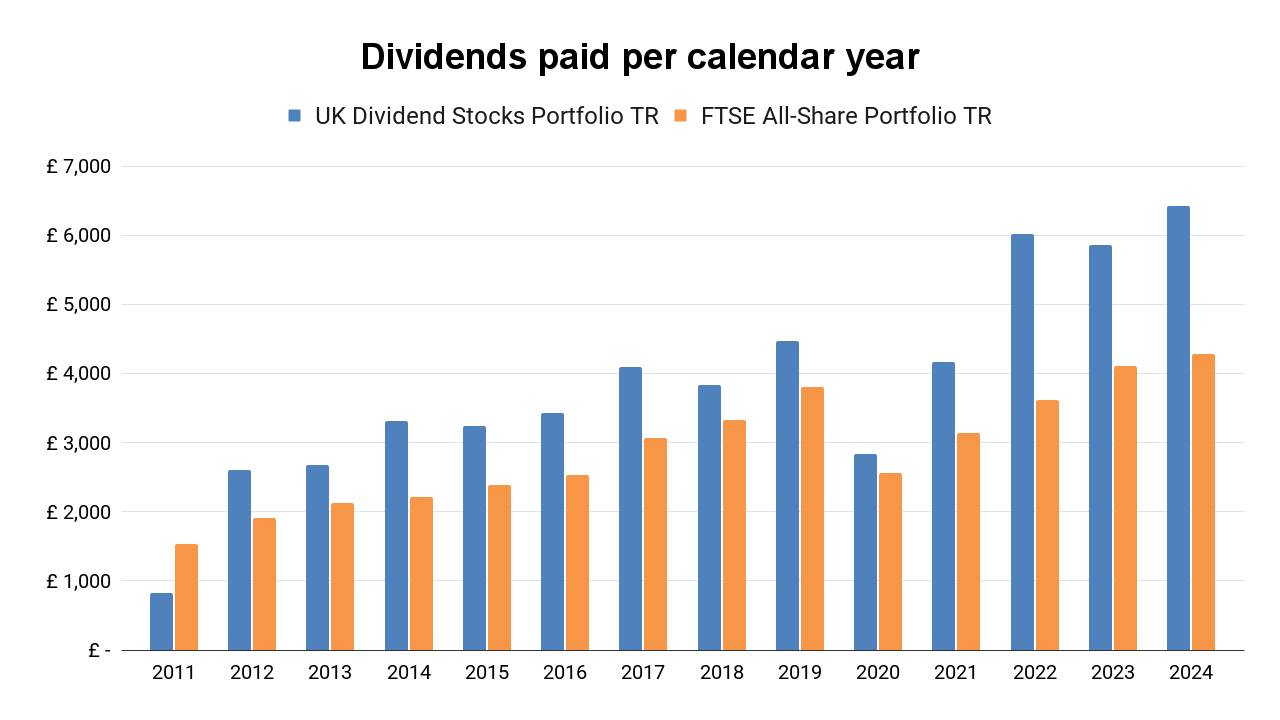

UK Dividend Focus

iShares UK Dividend UCITS ETF (IUKD)

- UK-focused dividend strategy

- Higher yield profile

Want to see your dividends properly?

Snowball Analytics lets you track income, growth, and yield across all your investments in one place.

Regional Income Diversification

Income Funds Inside an ISA: Why the Wrapper Matters

For UK investors, the ISA changes everything.

Inside a Stocks & Shares ISA:

- Dividends are tax-free

- Capital gains are tax-free

- Income can be reinvested or withdrawn later

Official guidance:

- How ISAs work:

https://www.gov.uk/individual-savings-accounts - Dividend tax rules (outside ISAs):

https://www.gov.uk/tax-on-dividends

This is why income planning often makes most sense inside an ISA, especially later in life.

A Sensible Long-Term Framework

Phase 1: Build the Engine

- Contributions matter more than yield

- Accumulation funds often dominate

Phase 2: Add Optionality

- Income provides flexibility

- Visible cash flow supports discipline

Most experienced investors eventually run both.

Growth builds the engine.

Income decides how and when it pays you back.

ISA Income Illustration

Frequently Asked Questions

Are income funds better than accumulation funds?

No, they’re different tools. Accumulation prioritises simplicity and growth. Income prioritises flexibility and cash flow.

Do income funds reduce long-term returns?

Not inherently. What matters is reinvestment behaviour, fees, and diversification.

Do I pay tax on dividends in an ISA?

No. Dividend income inside a Stocks & Shares ISA is tax-free.

https://www.gov.uk/individual-savings-accounts

Conclusion: Income Is a Feature, Not a Compromise

Income funds aren’t outdated.

They aren’t inferior.

And they aren’t just for retirement.

They’re a deliberate design choice for investors who value:

- flexibility

- visible progress

- long-term discipline

The strongest portfolios aren’t built on growth alone; they’re built on systems that investors can stick with.